Understanding Common Real Estate Closing Costs

Key Highlights

Closing costs are additional expenses beyond the purchase price when buying or selling a home.

These costs encompass various fees for appraisals, inspections, loan origination, title insurance, and more.

Buyers typically pay a larger portion of closing costs, often ranging from 2% to 5% of the purchase price.

Sellers cover expenses like real estate agent commissions, usually around 5-6% of the sale price.

Understanding and budgeting for these costs is crucial for a smoother real estate transaction.

Negotiation plays a role, and buyers can explore options to potentially minimize their out-of-pocket expenses.

Navigating real estate transactions can be tricky. There are costs involved that go beyond just the purchase price. These extra costs are called closing costs. It is important for buyers and sellers to understand them. Closing costs cover various services needed to complete a real estate transaction. These can include loan origination fees and title insurance, as well as real estate commissions. This guide will help you learn more about common real estate closing costs. It will help you make good decisions during the process.

Overview of Real Estate Closing Costs

Buying or selling a home is not just about the price you agree on. You also have to think about closing costs. These costs include different fees that come with wrapping up the deal, including a potential prepayment penalty for paying off your mortgage early. They pay for things like appraisals, inspections, loan processing, and title insurance. Though these costs can be a big part of your budget, knowing about them can help you avoid surprises and plan your money better.

Closing costs help both buyers and sellers. Buyers get peace of mind from assessments and insurance, while sellers meet their duties, like paying real estate agent commissions and covering the cost of necessary repairs found during the home inspection. These costs, known as seller concessions, can change depending on where you are, the loan type, and what you negotiate. By learning about these costs, you can feel more clear and secure as you close the deal.

Defining Closing Costs in Real Estate Transactions

In a real estate transaction, "closing costs" are extra expenses that buyers and sellers pay to finish the deal. These costs are more than the purchase price and include various fees for important services needed to complete the process in a legal and safe way. Some common closing costs include attorney fees, property appraisals, and mortgage fees. Knowing these costs ahead of time is very important for good financial planning.

A key document related to closing costs is the closing disclosure. The lender gives this to the buyer at least three business days before closing. It shows all the terms of the loan, including the details of the closing costs. Typical costs include loan origination fees, discount points if the buyer chooses them, appraisal fees, title searches, credit report fees, and title insurance.

Title insurance is an important part of closing costs. It protects both the lender and the buyer from any hidden title problems or claims that may show up after closing. The loan amount affects the total closing costs since some fees are based on a percentage of the loan.

The Role of Closing Costs in Pennsylvania Home Purchases

Buying a home in Pennsylvania comes with specific closing costs. These costs are influenced by state laws and common practices. It's important for both buyers and sellers to understand them.

Transfer taxes are a major part of closing costs in Pennsylvania. Both the state and local governments charge these taxes when property ownership changes hands. They are usually a percentage of the purchase price and are generally paid by the seller. If the property belongs to a Homeowners Association (HOA), buyers may also face transfer fees, which are known as Homeowners Association (HOA) Transfer Fees. These fees pay for administrative costs and help transfer record information.

Moreover, buyers should include mortgage recording taxes in their closing costs. The state of Pennsylvania imposes these taxes, and the cost can differ by county. This fee is usually a percentage of the mortgage amount.

Detailed Breakdown of Buyer's Closing Costs

Buyer's closing costs cover various fees that help protect their interests when buying a home. These costs ensure the property’s value and condition are checked. They also confirm there is a clear title. This way, the transaction is safe and legal.

These costs can be split into three types: lender-related fees, third-party fees, and prepaid or escrow items. Lenders charge fees for things like loan origination, underwriting, and other services. Third-party fees include appraisals, inspections, and title insurance. Prepaid or escrow items cover homeowners' insurance, property taxes, and mortgage insurance premiums.

Appraisal Fees: What You Need to Know

Appraisal fees are an important part of the cost's buyers pay when closing on a home. These fees cover the cost of hiring a qualified appraiser. The appraiser helps find the fair market value of the property. Lenders ask for appraisals to make sure the loan amount matches the actual value of the home, and these fees may be paid for separately or added to the loan balance. This protects their investment.

For buyers, having an appraisal is a good way to avoid overpaying for a house. The appraisal process includes a licensed appraiser visiting the property. They check the condition, size, and features of the home. They also compare it to similar homes that have recently sold in the area.

Appraisal fees can change based on location and how complex the property is. Generally, they cost a few hundred to over a thousand dollars. Buyers can ask their lender for a copy of the appraisal report. This report gives important details about the property's market value and any areas that may need fixing.

Title Searches and Insurance Explained

Title searches and title insurance are important parts of closing costs. They help buyers and lenders feel safe about who owns the property. A title search checks public records to find any liens, judgments, or problems that may affect the property's title.

After the title search, title insurance gives financial protection if any unexpected title problems come up after closing. Here’s how it works:

Title Search: Done by a title company, this checks public records to make sure there is a clear ownership chain and to find any possible issues.

Title Insurance: It protects against claims from hidden title problems, like unknown heirs, fake documents, or mistakes in public records.

Lender's Policy: This is required by lenders to protect their investment in the mortgage.

Owner's Policy: This is optional for buyers and protects their ownership rights.

Mortgage Application and Origination Fees

Navigating the mortgage process includes different fees. Two common fees are the application fee and the origination fee. These fees help cover the costs that come with processing your mortgage application and setting up your loan.

The application fee pays for the first steps of your application. This includes things like credit checks and early checks of documents. These fees can change depending on the lender. They are usually non-refundable, even if they do not approve your application.

The origination fee is what mortgage lenders charge for their admin work. It covers checking your financial history, confirming your job, valuing the property, and getting loan documents ready. This fee often shows up as a percentage of the loan amount. It usually falls between 0.5% and 1%, but it might be higher.

Understanding Seller's Closing Costs

Buyers usually pay many closing costs, but sellers have their own costs when they close a real estate deal. These costs mainly involve transferring ownership, paying off what they owe, and paying real estate professionals.

One big cost for sellers is the commission for the real estate agent. This cost is often split between the listing agent and the buyer’s agent. Other regular expenses include transfer taxes from local and state governments, prorated property taxes for the time they owned the home, and any unpaid HOA fees. It is important for sellers to understand these costs. This way, they can figure out how much money they will get from the sale.

Real Estate Agent Commissions in Detail

Real estate agent commissions are a big cost for sellers. They usually make up the largest part of the closing costs. Agents earn this commission by helping sell the property. This includes listing the home, marketing it, negotiating offers, and guiding both the seller and buyer through the closing process.

The commission is typically a percentage of the final sale price. This percentage usually ranges from 5% to 6%, but it can change based on location, market conditions, and what the seller and agent agree on. This percentage is split between the seller’s agent and the buyer’s agent. Each agent gets a part of the commission.

Although the commission might look like a lot of money, it is important to recognize the value of skilled real estate agents. They offer market knowledge, negotiation skills, and marketing know-how. Their help can lead to a successful and smooth sale.

Home Warranty Policies and Seller Concessions

In real estate deals, home warranty policies and seller concessions are useful for both buyers and sellers. They can change closing costs and make a deal more appealing.

A home warranty is often bought by the seller. It protects certain home systems and appliances for a specific time. This gives peace of mind to the buyer and can make the home more attractive. It might even help sell the home faster.

Seller concessions are when the seller agrees to pay some of the buyer's closing costs. These can be very tempting in a buyer's market or for homes that need repairs. By providing this help, sellers can make their offer more inviting to buyers.

If sellers and buyers negotiate well on these points, both can win. Sellers might sell their home faster, while buyers could reduce their upfront costs.

Who Pays for What? The Buyer-Seller Dynamic

In the complex world of closing costs, who pays what can be confusing. It shows how buyers and sellers work together. While customs can differ depending on where you are, there are some common rules.

Usually, buyers pay most closing costs. These costs are mainly for getting financing and insurance. They often include things like loan origination fees, appraisal costs, inspection fees, and title insurance. Sellers, however, mainly handle costs for transferring ownership and meeting their obligations. This includes real estate agent commissions, prorated property taxes, and any unpaid HOA fees.

Negotiating Closing Costs in Pennsylvania

Negotiating closing costs is very important in real estate deals, especially in a busy market like Pennsylvania. Both buyers and sellers can use their positions and knowledge about the market to find a deal that works for both sides.

For buyers, working on closing costs can lower initial expenses. This can free up money for moving or buying furniture. Checking local closing costs and getting quotes from different service providers, such as title companies and lawyers, can help during talks.

Sellers might think about helping with some closing costs. This can help speed up the sale or make the offer more appealing, especially when it’s a buyer's market. Factors like how the property looks, the number of homes available, and the buyer's finances will affect how well the negotiation goes.

Legal Requirements and Customary Practices

Legal rules and normal practices work together to influence closing costs in Pennsylvania. This helps to keep things clear and fair in real estate deals.

In Pennsylvania, laws require certain actions that affect closing costs. For example, the Real Estate Settlement Procedures Act (RESPA) says that lenders must give borrowers a loan estimate within three business days after they apply for a mortgage. This estimate shows key loan details and estimates closing costs.

Also, Pennsylvania's Plain Language Consumer Contract Act says that all contracts, especially in real estate, should be easy to read and understand. This helps buyers and sellers know the terms and conditions related to closing costs.

Reducing Your Closing Costs

While closing costs are a normal part of real estate deals, buyers and sellers can use different ways to lower these costs. Buyers can try to negotiate with the seller. They can also look for better rates for services like title insurance. Another option is to consider discount points to lower their interest rate by paying a fee upfront.

Sellers can also find ways to reduce their costs. They can negotiate real estate agent commissions. Some might choose to sell their property on their own. Others may offer incentives to buyers to help attract interest. This could help lower their closing costs.

Strategies for Buyers to Lower Expenses

Buyers who want to understand the real estate market often try to lower their upfront costs. Reducing closing costs is a keyway to do this. By using smart plans, buyers can save a lot of money. This can help them allocate funds to other important needs of owning a home.

One good strategy is to check out different mortgage rates and closing costs. Different lenders provide different terms. Comparing them can create big savings over the life of the loan. Another option to consider is negotiating with the seller, especially when it’s a buyer’s market. Asking the seller to help with some closing costs can benefit both parties. Buyers can also look into down payment aid programs from state and local governments or nonprofit groups.

Tips for Sellers to Minimize Out-of-Pocket Costs

While sellers usually pay less in closing costs than buyers, keeping these costs low is important. By using smart methods, sellers can increase the money they make from the sale, making it a better deal for them.

One key way to do this is by negotiating real estate agent commissions. Commissions are often a percentage of the sale price, but they can be flexible, especially in a busy market. If a seller offers a slightly higher commission to buyer’s agents, it may encourage them to bring more potential buyers to the property.

Timing the sale right can also help lower closing costs. Selling during quieter seasons or when there are lots of homes for sale might mean giving discounts or price cuts. However, it can also lead to lower closing costs due to less competition. If a seller receives multiple offers, they can negotiate with buyers for better closing cost agreements.

Timing and Payment of Closing Costs

Understanding when to pay closing costs is important for buyers and sellers. This helps to ensure a smooth real estate transaction. Closing, or settlement, is the final step in buying a home. It's when the seller officially transfers ownership of the property to the buyer.

At this stage, all remaining payments are settled, which includes closing costs. The exact date is set in the purchase agreement. Usually, closing happens a few weeks after the offer is accepted. This time allows for tasks like appraisals, inspections, and loan processing to be finished.

When Are Closing Costs Due?

Closing costs are the last step in a real estate deal. They are important costs that both buyers and sellers need to pay. When and how these costs are paid is key to a smooth change of property ownership.

Usually, closing costs are paid on the closing date, or settlement date. This date is chosen by both the buyer and the seller and is written in the purchase agreement. It often happens a few weeks after both parties agree on the offer. This gives enough time for key tasks, like appraisals, inspections, title searches, and processing loans.

Before the closing date, buyers get a closing disclosure from their lender. This document shows the total closing costs. It lists each cost clearly, helping buyers see if everything is correct. Sellers also get a similar document that shows their closing costs. This includes real estate agent commissions, property taxes they need to pay, and any unpaid fees from liens or homeowner associations.

Options for Financing Closing Costs

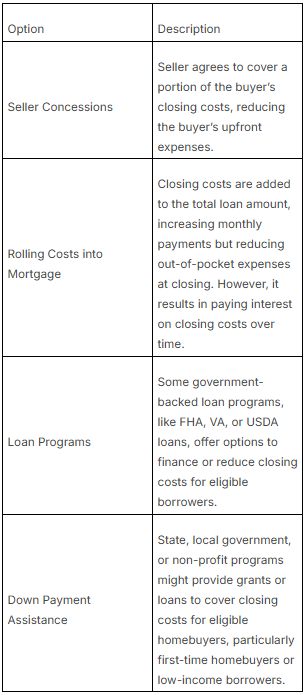

Financing closing costs has become an increasingly popular option for homebuyers, particularly in scenarios where upfront cash is limited. Several avenues exist for incorporating these expenses into the overall financing structure, providing flexibility and potentially easing the financial burden.

One common approach is to request the seller to pay a portion of the buyer's closing costs, often referred to as seller concessions. This negotiation tactic can be particularly effective in a buyer's market or for properties requiring repairs.

Alternatively, buyers can explore the option of rolling closing costs into their mortgage loan. This involves adding the closing costs to the total loan amount, spreading the expense over the life of the loan. While this approach reduces upfront out-of-pocket expenses, it's essential to note that it results in paying interest on the closing costs over time, ultimately increasing the overall loan cost.

Conclusion

In short, it is important to understand common real estate closing costs if you are a buyer or a seller. By looking at things like appraisal fees, title searches, mortgage fees, and agent commissions, you can better handle the tricky parts of real estate deals in Pennsylvania. Knowing who usually pays for these costs and finding ways to cut expenses can make the closing process smoother. Being well-informed helps you make better choices that can benefit your finances. So, whether you want to buy or sell, knowing about real estate closing costs can help you navigate the closing process with ease and confidence.

Click here to access all the active listing in Pennsylvania.

Frequently Asked Questions

Can closing costs be included in the mortgage in Pennsylvania?

Yes, in Pennsylvania, you can add some closing costs to your mortgage loan. This will increase the total loan amount. As a result, you will pay interest on those closing costs for the entire time of your loan.

What is the average amount of closing costs for buyers in Pennsylvania?

In Pennsylvania, the average closing costs for buyers are usually between 2% and 5% of the purchase price. However, the actual closing costs can change. This depends on things like the loan type, the purchase price, and the location.

Are there any ways to reduce closing costs?

You can lower your closing costs by talking with the seller, looking for lower lender fees, or checking out seller concessions. Discount points are another option. You pay a fee upfront to get a lower interest rate.

Who typically pays the title insurance in Pennsylvania, the buyer or the seller?

In Pennsylvania, the buyer usually pays for title insurance when closing a real estate transaction. However, this detail can be negotiated between the buyer and seller in the real estate contract.

How can I negotiate closing costs with my lender?

To discuss closing costs with your lender, begin by looking at loan estimates from various lenders. Comparing different offers can help you ask for lower fees or a credit for closing costs.