Single Family House or Condo: Which to Choose?

Condo in Pennsylvania

Key Highlights

Single-family homes and condos are two popular property types to consider when buying a home.

Single-family homes offer more privacy and personal space, while condos provide access to amenities and a sense of community.

Homeowner's associations (HOAs) are common with condos and come with fees for maintenance and access to amenities.

Condos are typically more affordable than single-family homes, but homeownership costs can vary depending on location and HOA fees.

Ultimately, the choice between a single-family home and a condo depends on individual preferences and lifestyle needs.

When it comes to choosing a place to call home, the decision between a single-family house and a condo can be a challenging one. Both options have their own unique advantages and considerations, making it important to carefully evaluate your needs and preferences before making a decision. This blog will explore the key differences between single-family houses and condos, including factors such as property ownership, maintenance responsibilities, access to amenities, and financial considerations. By understanding the basics and weighing the pros and cons of each option, you can make an informed choice that suits your lifestyle and goals.

Understanding the Basics

Before diving into the differences between single-family houses and condos, it's essential to understand the basics of these property types. A single-family house is a standalone structure that is located on its own plot of land, providing homeowners with complete ownership and control over the property. On the other hand, a condo is a housing unit within a larger complex, where owners have ownership rights to their individual units but share common areas and responsibilities with other condo owners. It's important to note that condos are often governed by a homeowner's association (HOA), which enforces rules and regulations and collects fees for maintenance and amenities.

Defining Single Family Houses and Condos

Let's delve deeper into the definitions of single-family houses and condos. A single-family house, also known as a detached house, is a type of residential property that stands alone and is not connected to any other dwelling. It provides homeowners with the freedom and privacy of owning their own land and structure. On the other hand, a condo, short for condominium, is a type of property where individual units are owned by residents, but common areas and facilities are shared among all condo owners. Condos can be found in various types of buildings, including high-rise towers, low-rise buildings, or even townhouse-style complexes. The number of units within a condo building can range from just a few to hundreds, depending on the size and scale of the development.

House in Pennsylvania

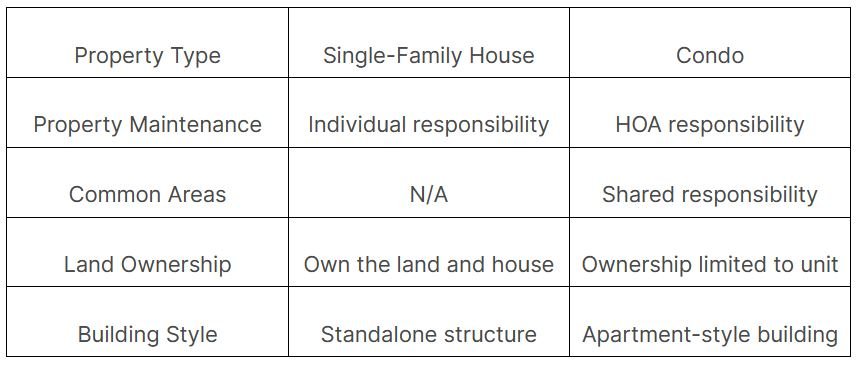

Key Differences Between Single Family Houses and Condos in Pennsylvania

If you're considering the choice between a single-family house and a condo in Pennsylvania, it's important to understand the key differences between these two property types. One major distinction is in property maintenance responsibilities. In a single-family house, you are solely responsible for the maintenance and upkeep of your home and the surrounding land. This includes tasks such as lawn care, snow removal, and exterior repairs. On the other hand, condos typically have an HOA that takes care of maintenance tasks for the common areas and exterior of the building. This can be a significant advantage for those who prefer a more hands-off approach to property upkeep. Additionally, single-family houses offer the benefit of owning your own land, providing more space and privacy. Condos, on the other hand, often share walls with neighboring units and may be located in larger apartment-style buildings.

Advantages of Single-Family Houses

Single-family houses offer several advantages that make them appealing to many homebuyers. One significant advantage is privacy and personal space. With your own plot of land, you have the freedom to enjoy spacious yards, create a backyard oasis, and have more control over your living environment. Unlike condos, you don't have to worry about noise from neighbors or sharing common spaces. Additionally, single-family houses often provide more flexibility when it comes to customization. You can personalize your home to fit your style and needs without having to adhere to HOA rules or restrictions.

Privacy and Personal Space

One of the key advantages of owning a single-family house is the privacy and personal space it offers. Unlike condos, which often share walls and have neighbors in close proximity, single-family houses provide homeowners with their own standalone structure. This means that you have more control over your living environment and can enjoy a greater sense of privacy. Single-family houses also typically come with larger yards, providing ample outdoor space for gardening, recreation, and entertaining. Whether you value quiet solitude or enjoy hosting gatherings, a single-family house can offer the privacy and personal space that may be lacking in a condo setting. Additionally, owning your own land gives you the freedom to make changes and enhancements to your property without having to seek approval from an HOA.

Freedom to Customize

Another advantage of single-family houses is the freedom to customize your living space according to your preferences and needs. Unlike condos, which often have homeowner's associations (HOAs) with rules and restrictions, single-family houses give you more control over how you use and modify your property. Here are some key points to consider:

No restrictions from an HOA: Single-family houses are not typically subjected to the rules and regulations enforced by an HOA. This means you have more freedom to choose paint colors, make renovations, and customize your home as you see fit.

Direct access to your property: With a single-family house, you have direct access to your property without having to pass through common areas or shared spaces. This allows for a greater sense of autonomy and privacy.

More space for personalization: Single-family houses often provides more space, both indoors and outdoors, for customization. Whether it's creating a home office, building a deck or patio, or landscaping your yard, you have more room to express your personal style and create a living environment that suits your needs and preferences.

Advantages of Condos

While single-family houses have their advantages, condos also offer unique benefits that appeal to a wide range of homebuyers. One major advantage is the access to amenities and community living. Condo communities often provide residents with amenities such as pools, fitness centers, and common spaces that would be costly and time-consuming to maintain in a single-family house. Additionally, living in a condo can foster a sense of community, with opportunities to meet and socialize with neighbors. The maintenance and security benefits of condos can also be appealing, as exterior maintenance and security measures are typically the responsibility of the HOA.

Amenities and Community Living

One of the key advantages of living in a condo is the access to amenities and community living. Condo communities often offer a range of shared amenities that can enhance your lifestyle and provide convenience. Some common amenities in condo communities include:

Pools and fitness centers: Many condo communities have on-site pools and fitness centers, allowing residents to stay active and enjoy recreational activities without having to leave the property.

Clubhouses and common spaces: Condos often have shared spaces, such as clubhouses or community rooms, that can be used for gatherings, parties, or other social events. These common areas provide opportunities to meet and interact with neighbors, fostering a sense of community.

Other amenities: Depending on the condo community, additional amenities such as parks, playgrounds, tennis courts, and walking trails may be available for residents to enjoy.

Living in a condo can provide a convenient and low-maintenance lifestyle, with access to amenities that may not be feasible or affordable in a single-family house. The shared amenities in condo communities can enhance your leisure time and provide opportunities for socializing and building relationships with your neighbors.

Maintenance and Security Benefits

In addition to the amenities and community living, condos offer maintenance and security benefits that can be appealing to many homeowners. Here are some key points to consider:

Exterior maintenance: One major advantage of living in a condo is that the exterior maintenance is typically taken care of by the condo association. This includes tasks such as landscaping, snow removal, and exterior repairs. This can save homeowners time and money compared to the maintenance responsibilities of a single-family house.

Security benefits: Condo communities often have security measures in place, such as gated entrances, security cameras, and on-site security personnel. This can provide peace of mind and an added layer of security for residents.

Monthly fees: Condos typically have monthly fees that cover the cost of maintaining the common areas, amenities, and security measures. While these fees are an additional expense, they can also provide a sense of security and convenience, as the responsibility for maintenance and upkeep is shared among all condo owners.

Financial Considerations

When deciding between a single-family house and a condo, it's important to consider the financial aspects of homeownership. Both options have their own cost considerations, and it's essential to evaluate your budget and long-term financial goals. Factors such as initial costs, mortgage differences, HOA fees, and maintenance costs can all impact the financial implications of your decision. Understanding these considerations can help you make an informed choice and ensure that your homeownership experience aligns with your financial situation.

Financial Considerations

Initial Costs and Mortgage Differences

When comparing the financial aspects of single-family houses and condos, it's important to consider the initial costs and mortgage differences. Here are some key points to consider:

Initial costs: Single-family houses generally have higher purchase prices compared to condos. However, it's important to consider other factors such as property taxes, closing costs, and insurance premiums when evaluating the overall affordability.

Mortgage differences: Both single-family houses and condos can be financed with a mortgage loan. However, lenders may have different requirements and terms for each property type. It's important to consult with a mortgage professional, such as Rocket Mortgage®, to understand the specific mortgage options and eligibility requirements for the property type you're considering.

Credit score: Your credit score plays a significant role in the mortgage approval process. Lenders typically require a higher credit score for a mortgage on a single-family house compared to a condo. It's important to review and improve your credit score before applying for a mortgage to secure the best terms and interest rates.

HOA Fees vs. Maintenance Costs

When comparing the financial aspects of single-family houses and condos, it's important to consider the ongoing costs of homeownership. Here are some key points to consider:

HOA fees: Condos typically have monthly HOA fees that cover the cost of maintaining the common areas, amenities, and security measures. These fees can vary significantly depending on the condo community and the level of services provided. It's important to factor in these fees when budgeting for homeownership and to understand the impact on your monthly expenses.

Maintenance costs: Single-family houses require homeowners to take care of all maintenance and repairs, which can add up over time. Condos, on the other hand, often have exterior maintenance tasks covered by the HOA. However, it's important to budget for potential interior maintenance and repairs that may still be your responsibility as a condo owner.

Lifestyle and Location

When choosing between a single-family house and a condo, lifestyle and location are important factors to consider. Your lifestyle needs and preferences, as well as the impact of location on your daily life, can greatly influence your decision. Factors such as zoning, proximity to amenities, and the type of property that aligns with your lifestyle can play a significant role in determining whether a single-family house or a condo is the right choice for you.

Farmers marketing

Assessing Your Lifestyle Needs

Assessing your lifestyle needs is crucial when deciding between a single-family house and a condo. Here are some key points to consider:

Homeowners insurance: Single-family houses typically require homeowners' insurance that covers both the structure and the land. Condos, on the other hand, often only require insurance coverage for the interior of the unit.

Zoning: Consider the zoning regulations in the area where you want to live. Zoning restrictions can impact what you can do with your property, such as running a home-based business or making significant renovations.

Proximity to amenities: Consider the proximity of your potential home to amenities such as schools, shopping centers, parks, and recreational facilities. Think about your daily routine and the convenience of access to these amenities.

Lifestyle preferences: Consider your lifestyle preferences and how they align with the characteristics of a single-family house or a condo. Do you prefer a sense of community and shared amenities, or do you value privacy and personal space?

The Impact of Location on Your Choice

Location is a key consideration when deciding between a single-family house and a condo. The impact of location on your choice can be significant, affecting factors such as property taxes, zoning regulations, proximity to amenities, and the type of property available. Here are some key points to consider:

Property taxes: Property tax rates can vary depending on the location and the type of property. It's important to research and understand the property tax implications of both single-family houses and condos in the areas you're considering.

Zoning regulations: Zoning regulations can determine what type of properties are allowed in certain areas. Some neighborhoods may have restrictions on the types of properties, such as single-family houses only or a mix of single-family houses and condos.

Proximity to amenities: Consider how the location of your potential home impacts your proximity to amenities such as schools, parks, shopping centers, and transportation options. Think about your daily commute and access to the things that are important to you.

Type of property available: The availability of single-family houses and condos can vary depending on the location. Some areas may have more options for one type of property over the other, so it's important to consider the availability and variety of properties in the areas you're interested in.

Resale Value and Investment Potential

Resale value and investment potential are important factors to consider when deciding between a single-family house and a condo. Understanding the future marketability of the property and its long-term investment potential can help you make an informed decision. Factors such as the resale value, market trends, and the impact of property taxes can influence the potential return on investment for both single-family houses and condos.

Resale value

Future Marketability of Single-Family Houses vs. Condos

When considering the future marketability of a property, both single-family houses and condos have their own factors to consider. Here are some key points to keep in mind:

Resale value: Single-family houses generally have a higher resale value compared to condos. This is often due to the desirability of owning a standalone structure and having more space and privacy.

Marketability: The marketability of a property can be influenced by factors such as location, demand, and the overall real estate market. It's important to research and understand the market trends and demand for both single-family houses and condos in the areas you're considering.

Investment property: Both single-family houses and condos can be viable options for investment properties. Consider factors such as rental demand, potential rental income, and the ease of finding tenants when evaluating the investment potential of a property.

Red flag: Multiple units for sale in a condo community at the same time can be a red flag, both for potential residents and future buyers. It's important to research the condo community and its financial stability before making a purchase.

Long-Term Investment Considerations

When considering the long-term investment potential of a property, it's important to evaluate factors such as property appreciation, rental income potential, and property taxes. Here are some key points to consider:

Property appreciation: Historically, real estate has proven to be a solid long-term investment. Both single-family houses and condos can appreciate in value over time, but market conditions and location can play a significant role in the potential for appreciation.

Rental income potential: Both single-family houses and condos can be rented out as investment properties. Consider factors such as rental demand, rental income potential, and the ease of finding tenants when evaluating the investment potential of a property.

Property taxes: Property taxes can impact the long-term investment potential of a property. It's important to research and understand the property tax rates and regulations in the areas you're considering, as higher property taxes can affect the overall return on investment.

Conclusion

In conclusion, whether you opt for a single-family house or a condo depends on your lifestyle, preferences, and financial considerations. Single-family houses offer privacy and customization opportunities, while condos provide amenities and a sense of community. Understanding the impact of location, maintenance costs, and long-term investment potential is crucial in making your decision. Consider your future needs and resale value when choosing between the two. If you're a first-time buyer, weigh the pros and cons carefully. Ultimately, both property types have their advantages, so choose the one that aligns best with your living requirements and investment goals.

Frequently Asked Questions

Which is Better for First-Time Buyers?

For first-time buyers, the choice between a single-family house and a condo depends on factors such as affordability, desired lifestyle, and long-term goals. Consider your budget, the ongoing costs of homeownership, and your future plans when making this decision.

How Do HOA Fees Affect My Buying Decision?

HOA fees can impact your buying decision when considering a condo. These fees cover maintenance and amenities but can add to your monthly expenses. It's important to budget for these fees and understand what they cover before making a purchase.

![Your Home Buyer Wants To Extend The Closing Date—What Now? [PART 2]](https://images.squarespace-cdn.com/content/v1/5e0e87b1895612115fa41863/1764095515299-WC8HHFSMSW18HFML5B9M/banner.jpg?format=200w)

![Your Home Buyer Wants To Extend The Closing Date—What Now? [PART 1]](https://images.squarespace-cdn.com/content/v1/5e0e87b1895612115fa41863/1763490694596-WWL63B4MTE2BKCEFB1AU/banner.jpg?format=200w)